As pioneers in the startup VC ecosystem, Accel (formerly known as Accel Partners), with over four decades of experience, entered the Indian market in 2008. They placed their initial bets on a nascent e-commerce company poised to compete with Amazon.

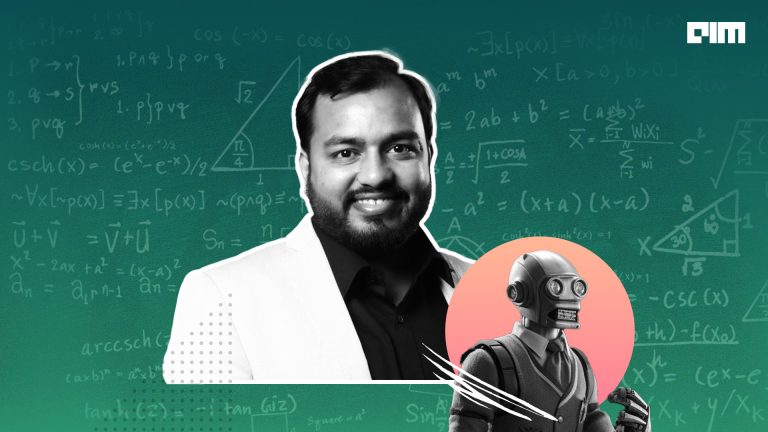

In 2008, Accel India invested $800,000 in seed capital into Flipkart, followed by $100 million in subsequent rounds. The VC firm went on to back some of today’s most successful ventures, including AI startups. “We’ve invested in 27 [AI] companies in the last couple of years, which basically means we believe these 27 companies will be worth five to ten billion dollars [in the future],” said Prayank Swaroop, partner at Accel, in an exclusive interaction with AIM.

Swaroop, who joined Accel in 2011, focuses on cybersecurity, developer tools, marketplaces, and SaaS investments, and has invested in companies such as Aavenir, Bizongo, Maverix, and Zetwerk. Having placed careful bets in the AI startup space, he continues to be optimistic, yet wary, about the Indian ecosystem.

Swaroop observed that while the Indian ecosystem has impressive companies, not all can achieve significant scale. He mentioned that they encounter companies that reach $5 to $10 million in revenue quickly, but they don’t believe those companies can grow to $400 to $500 million, so they choose not to invest in them.

Swaroop told AIM that Accel doesn’t have any kind of capital constraints and can support as many startups as possible. However, their focus is on startups with the ambition to grow into $5 to $10 billion companies, rather than those aiming for $100 million. “I think that is our ambition,” he said.

Accel has also been clear about having no inhibition in investing in wrapper-based AI companies. They believe that as long as the startup is able to prove that they will find customers by building GPT or AI wrappers on other products, it is fine.

“The majority of people can start with a wrapper and then, over a period of time, build the complexity of having their own model. You don’t need to do it from day one,” said Swaroop.

However, he also pointed out that for a research-led foundational model, it’s crucial to stand out, and that one cannot just create a GPT wrapper and claim it’s a new innovation.

Accel has invested in a diversified portfolio including food delivery company Swiggy, SaaS giant Freshworks, fitness company Cult.fit, and insurance tech Acko. Accel has made its second highest number of investments in India with a total of 218 companies, only behind the United States with 572. In 2022, the market value of Accel’s portfolio was over $100 billion.

Accelerating AI Startups

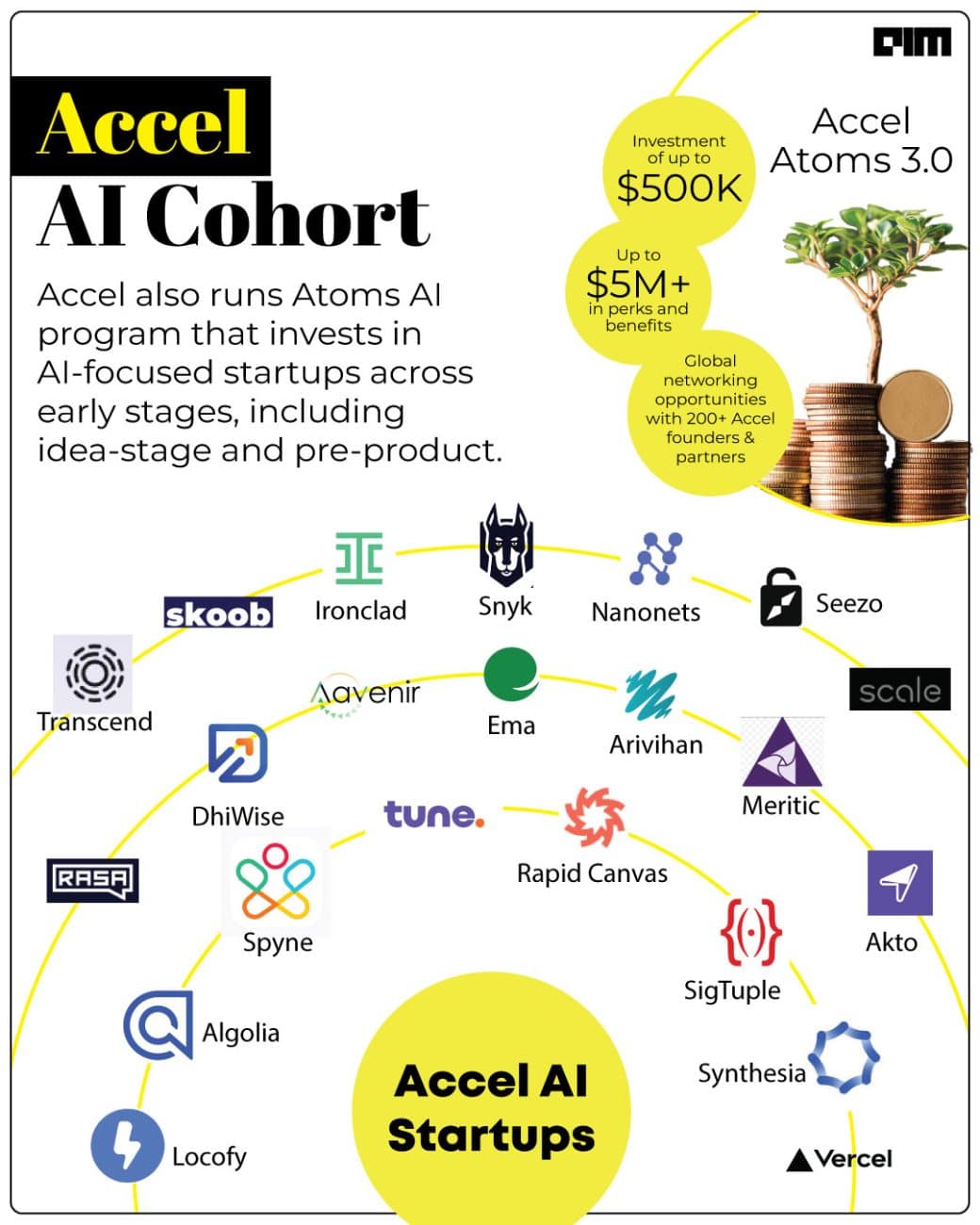

Accel has a dedicated programme called Accel Atoms AI that looks to invest in promising AI-focused startups across early stages. The cohort of startups will be funded and supported by Accel partners and founders to help them grow faster.

Selected startups in Accel Atoms 3.0 received up to $500k in funding, cloud service credits, including $100,000 for AWS, $150,000 for Microsoft Azure, $250,000 for Google Cloud Platform, GitHub credits, and other perks. The latest edition, Atoms 4.0, is expected to begin in a couple of months.

While these programmes are in place, Accel has been following a particular investment philosophy for AI startups.

Accel’s Investment Philosophy

The investment philosophy of Accel when it comes to AI startups entails a number of key criteria, that includes even the type of team. “It’s a cliched thing in VC, but we definitely look at the team,” said Swaroop, saying that they need to have an appreciation of AI.

He emphasised that teams must embrace AI, and be willing to dive into research and seek help when needed, demonstrating both a commitment to learning and effective communication.

Accel also focuses on startups that solve real problems. Swaroop believes that founders should clearly identify their customers and show how their solution can generate significant revenue.

“We get team members who are solving great things, and we realise they are solving great things, but they can’t say that. When they can’t say that, they can’t raise funding. Basically, are you a good storyteller about it?” he explained.

Revenue Growth Struggles

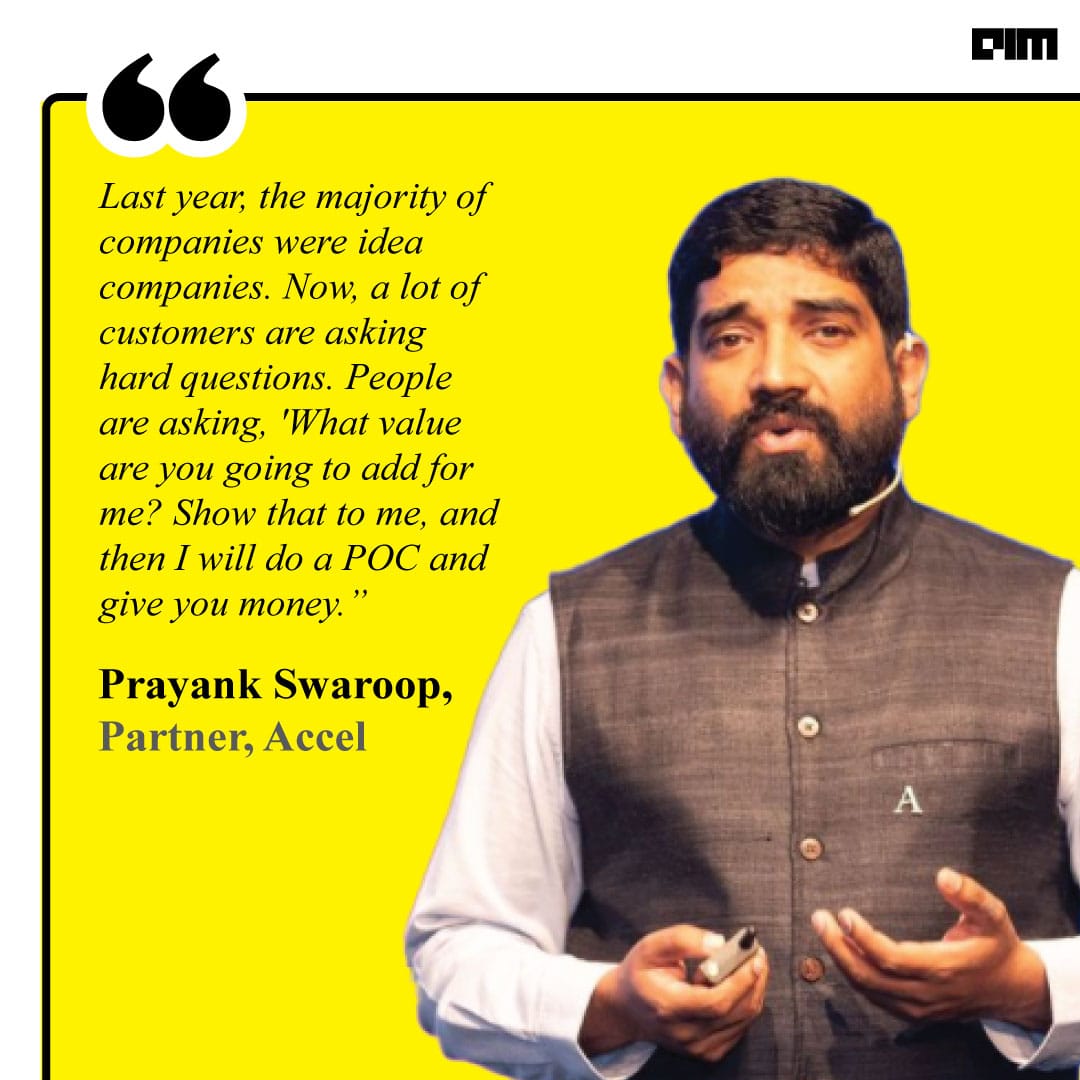

Swaroop further explained how VCs are increasingly expecting AI startups to demonstrate rapid revenue growth.

Unlike traditional deep tech companies that may take years to generate revenue, AI firms must show significant commercial traction within 12 to 18 months. He also stated that as VC investment in AI rises, startups without clear revenue paths face growing challenges in securing funding.

“Even to the pre-seed companies, we say, ‘Hey, you need to show whatever money you have before your next fundraiser. You need to start showing proof that customers are using you.’ Because so many other AI companies exist,” he said.

Swaroop also highlighted how investment behaviour for AI startups has changed over the last year where investors are now asking the hard questions.

VCs Obsess Over Data Moats

Speaking about what differentiates an AI startup and their moat, Swaroop highlighted how the quality of datasets may be a deciding factor; and “not so much” with Indic datasets.

“I don’t think language datasets can be a moat, because everybody understands language. Recently, in the Bhashini project, IISc gave out 16,000 hours of audio, so it is democratic data. Everybody owns it, so what’s proprietary in it for you?” asked Swaroop.

Proprietary datasets, such as those in healthcare or specialised fields, are valuable due to their complexity and the effort required to create them. “I think startups should pick and choose an area where they have uniqueness of data, where they will have proprietary data which is different from just democratic data. That’s the broad thing,” said Swaroop.

Irrespective of the moat, India continues to be a great market with multiple opportunities for investment. In fact, at a recent Accel summit, Swaroop jokingly mentioned how he did not invest in Zomato during its early stage, but there are no regrets. Interestingly, Accel has invested heavily in Zomato’s competitor, Swiggy.

“I think the first thing you have to let go of as a VC is FOMO, the fear of missing out, that’s why I could not think of a company that I regret not investing in, because, my belief is that India is a great market. Smart founders come and keep on coming. We’ll have enough opportunities to invest in,” concluded Swaroop, excited to meet the next generation of founders working in the AI startup ecosystem.