|

Listen to this story

|

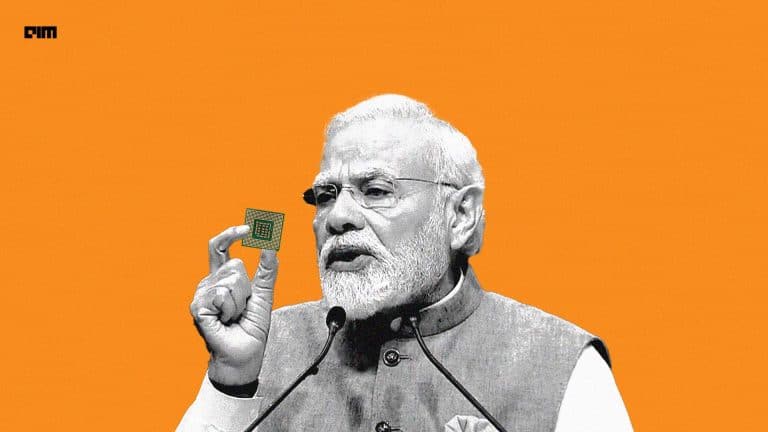

Indian Prime Minister Narendra Modi is scheduled to inaugurate ‘Semicon India 2023,’ an exhibition highlighting India’s semiconductor prowess and chip design innovation, on 28th July in Gandhinagar, Gujarat. The event is expected to feature prominent names such as Micron, AMD, IBM, Marvell, LAM Research, NXP Semiconductors, STMicroelectronics, Vedanta and Foxconn. Over the years, the Indian government has been actively involved in establishing India as a semiconductor manufacturing hub, and in line with this vision, has announced numerous initiatives and policies to promote domestic semiconductor industry growth.

In 2021, the Indian government announced a semiconductor package worth INR 76,000 crore to give the semiconductor space in India a significant boost. Subsequently, union minister Ashwini Vaishnaw announced four distinct schemes encompassing all aspects of the semiconductor supply chain. Among these, the Design Linked Incentive (DLI) scheme aimed to foster and enhance India’s proficiency in semiconductor design.

Now, according to recent reports, the government is currently formulating a proposal to bolster domestic semiconductor chip design companies by acquiring an equity stake in these firms. This initiative is planned as a component of the second phase of the DLI scheme. Currently, the combined revenue of domestic semiconductor design companies is marginal, somewhere between USD 30-40 million. However, experts are sceptical and fear the government acquiring stakes in domestic semiconductor chip design companies could backfire.

Government shouldn’t play VC

By acquiring stakes in these companies, the government plans to create a bunch of ‘fabless’ companies and nurture a chip design ecosystem in the country. In addition, the government aims to safeguard these companies from selling a substantial portion or all of their shares to international entities, as it seeks to enable their growth and establish them as robust fabless players.

However, while this might help the companies in the short run, what they need to stay competitive in the long run is good product development ideas, according to industry experts. “Don’t understand the logic of the government trying to become a venture capital firm for chip design companies. This move is likely to be ineffective and inefficient,” Pranay Kotasthane, a public policy researcher said.

He thinks if the goal of the Indian government is to create world-class Indian intellectual property, this action is unlikely to achieve it. Companies are naturally inclined to choose foreign buyers as it offers higher valuations and provides access to a global network of customers and investors.

Moreover, the Narendra Modi-led administration has received immense criticism because of their decision to sell many Indian Public Sector Undertaking (PSU) which were underperforming, or had significant underutilised assets that can be monetised. Given the government’s inability to turnaround these underperforming PSUs, it remains to be seen how the government can bring value to the domestic semiconductor chip design companies.

Accessibility to capital

Besides, a government intervention could be wrong for a multitude of reasons. One of the primary challenges plaguing domestic semiconductor chip design companies is accessibility to capital. In contrast to the software industry, the semiconductor sector has a longer gestation period for return on investments. With tapeout and the final product taking at least three years to reach the market, semiconductor design firms struggle to attract potential investors and venture capitalists, unlike software companies with quicker turnaround times. Hence, the government taking stakes in these companies could further discourage private investors from investing in these companies if the government owns a significant stake, limiting access to vital capital and hindering growth.

Furthermore, government ownership might lead to increased interference in the companies’ operations and decision-making processes, potentially hampering their ability to innovate and compete in the global market. Additionally, government ownership may also expose these companies to political pressures, affecting business decisions and overall competitiveness.

Overall, while the government may intend to support domestic semiconductor chip design companies, acquiring stakes in these firms can lead to unintended consequences and hinder long-term growth and competitiveness in the industry. In return, what the government should do is remove the funding barriers that currently exist. “Removing barriers through facilitating more FDI and long-term foreign-domestic private sector linkages can help integrate India’s semiconductor design market with the global markets,” Kotasthane added.

India’s semiconductor ambitions

So far, the government of India has approved five players under the DLI scheme, Vaishnaw said while speaking at the Bharat 6G Alliance, the Centre for Development of Advance Computing (C-DAC), earlier this month. During the same time, it was also announced that US-based Micron technology and the Gujarat government signed a Memorandum of Understanding (MoU) to set up an ATMP (assembly, test, marking, and packaging) facility in the state.

However, previously, a joint venture between Vedanta Limited and with Taiwanese electronics manufacturer Foxconn had announced that it will set up its semiconductor and display manufacturing facility at the Dholera Special Investment Region near Ahmedabad, Gujarat.

But as it stands, the JV no longer exists and both parties are seeking new partners to set up fabs in the country. While Vedanta is yet to find a partner, reports suggest Foxconn could partner with TSMC and Japan’s TMH Group to keep its ambitions of building chips in India alive. Other players to have shown interest include Tata Electronics, IGSS Ventures, and ISMC; however, nothing concrete has happened on either front.