|

Listen to this story

|

During the RAISE 2020, Reliance Group head honcho Mukesh Ambani said, “AI and other associated technologies of the fourth Industrial Revolution will vastly expand our capacity to solve the most complex and pressing problems before India and the world.” He also added that AI will help India in moving faster toward transforming India into a high-growth economy on its way to USD 5 trillion.

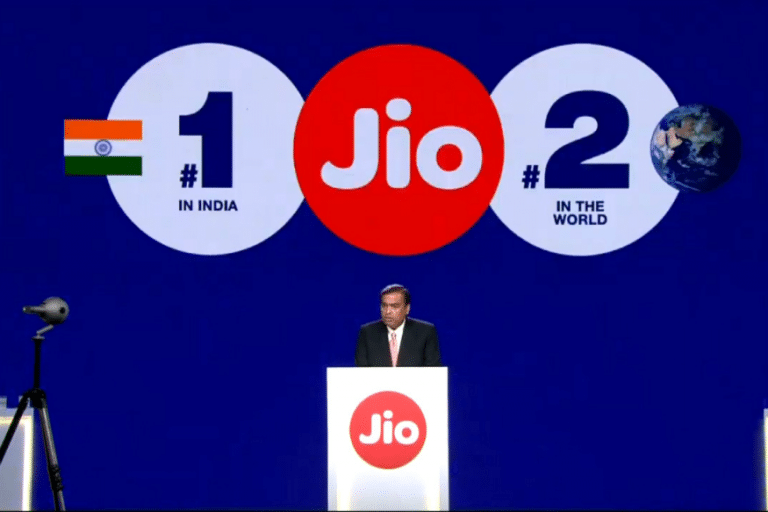

Ambani’s optimism in the technology is well supported by Reliance Group’s investment strategy in the field of artificial intelligence. Reliance’s digital clout is growing in the country, so much so that it has raised fears of a monopoly. Many believe that Reliance is aggressively scouting for AI and NLP companies in the digital space in a bid to create an Indian equivalent of FAANG – Facebook, Apple, Amazon, Netflix, and Google.

Investments and acquisitions

A 2018 media report said that Reliance Industries and its auxiliaries had set aside USD 2 billion for its multi-design strategy approach to transforming into a Technology and Innovation powerhouse. This strategy involves spending USD 1.6 billion on purchasing stakes in technology-driven companies situated in different countries, including the USA, the UK, and India. The remaining amount would be directed towards creating in-house tech in artificial intelligence, machine learning, blockchain, augmented reality, Internet of Things, robotics, and Big Data analytics, among other emerging technologies.

Earlier this year, Reliance Industries invested USD 15 million in Silicon Valley-based Two Platforms to take over a 25 per cent stake in the company. A deep-tech company founded by Pranav Mistry in 2021, Two Platforms is building interactive and immersive AI experiences. This AI platform enables real-time AI voice and video calls, digital humans, and lifelike gaming. In a statement, the Director of Jio, Akash Ambani, had then said that this investment would help in expediting the development of new products in the areas of interactive AI, immersive gaming, and the metaverse.

In the same month, Reliance Jio Platforms, the tech arm of Reliance, invested USD 200 million in InMobi’s mobile content startup Glance. This company uses algorithms to deliver personalised news, entertainment content and live videos, making them available right on the smartphone lock screens. Glance is also backed by Google and PayPal co-founder Peter Thiel’s Silicon Valley-based venture fund Mithril Capital.

In January, Reliance made an investment of a whopping USD 132 million with a majority stake in robotics company Addverb Technologies. The Noida-based startup is one of the few companies in the world that work on every aspect of robotics. Post the investment, the total valuation of the company stood at USD 270 million. Even before the investment, Addverb’s creations were adopted across Reliance’s different businesses, including JioMart, Ajio, and Netmeds.

Last year, Reliance invested USD 8 million in California-headquarter NetraDyna, an AI startup which focuses on commercial fleet safety. Founded by former Qualcomm India & South Asia president Avneesh Agrawal and his Qualcomm colleague David Julian, NetraDyne has developed Driveri, vision-based driver retention and safety platform for commercial vehicles. In 2016 too, Reliance had invested USD 16 million in the company. With the combined value of the two investments, Reliance now owns a 37.4 per cent stake in the startup.

Another major investment made by Reliance was in 2019 when Reliance Jio Digital Services entered into a strategic transaction with the conversation AI platform Haptik. In a statement, the company said that the transaction size was estimated to be Rs 700 crore, with Rs 230 crore considered for the initial business transfer. At that time, Akash Ambani had said that this investment would boost the digital ecosystem and offer users conversational AI-enabled devices with multi-lingual capabilities. With Haptik on board, Reliance’s focus has been on the enhancement and expansion of Jio, with a market opportunity of 1 billion users.

Interestingly, Reliance began realising the potential of AI and machine learning much before the sudden traction that these fields are now receiving. In 2014, Reliance made an investment of USD 100,000 in Detect Technologies Pvt Ltd, which makes real-time pipeline monitoring systems to track leaks and corrosions using AI and other sensors.

Other notable investments/acquisitions made by Reliance include deep tech startup Tesseract; Pharma-based enterprise platform C-Square; AI-based edtech platform Embibe, among others.

AI talent

In 2018, Reliance announced the launch of JioInteract. It was touted by its parent company as the world’s first artificial intelligence-based brand engagement video platform. Under the leadership of Akash Ambani, the company soon started hiring professionals to build its emerging technology firm. Spearheaded by Akash Ambani, the JioCoin project was responsible for building a team of young professionals.

Further, Reliance is also investing in AI education. Reliance-owned Jio University also offers a post-graduate programme in AI and data science. As per the website, the programme aims to “instil theoretical capabilities and provide the know-how to create practical solutions for enterprise and society.”

What next

The investments and acquisitions in the recent past indicate Reliance’s conscious efforts to pivot from its image of just a petrochemical giant to a digital enterprise with ventures like Jio and JioMart. As noted above, Reliance has acquired or invested in a dozen tech startups across domains like health tech, SaaS, robotics, edtech, etc. It aims to become a ‘tech tornado’ for the next-generation technology world.

At the RAISE 2020 event, Mukesh Ambani said, “In the past, nations have competed on physical capital, financial capital, human capital and intellectual capital. But, in the coming decades… nations will increasingly compete on Digital Capital,” Ambani said. He added that 1.3 billion Indians are digitally empowered to create faster economic growth, prosperity, employment opportunities, and better standards of living.