Data-driven solutions have become an integral part of firms across industries as they strive to improve decision-making or automate processes. Subsequently, the number of vendors providing analytics has increased considerably in India over the last couple of years. Choosing the right data science service provider has become one of the most crucial decisions enterprises make.

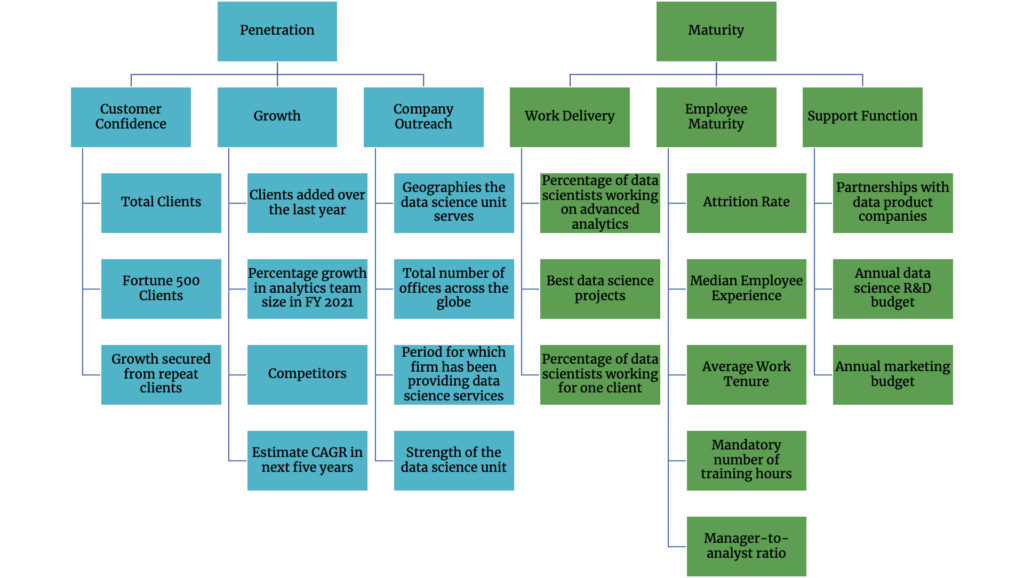

To assist enterprises in making this decision, Analytics India Magazine (AIM) has come up with the Penetration and Maturity (PeMa) Quadrant — an industry benchmark of vendor capabilities. AIM measures key parameters of leading service providers in terms of Penetration (Pe) and Maturity (Ma) and plots the relative positions of the firms on the Quadrant.

A balance between both these parameters is essential to respond to a client’s business challenges and seize revenue opportunities. The PeMa Quadrant, thus, helps enterprises get a complete overview of the capabilities and experience of vendors available in the market and consider how they are stacked against each other.

You can read the PeMa reports from previous years here:

The 2021 PeMa study is a result of extensive primary and secondary research carried out across the market. The primary research details were collected by circulating a survey form across the companies.

The questions in the survey were curated by conducting preliminary research to identify what aspects define Penetration and Maturity of a Data Science vendor the best. Vendors were scored for each question in the survey form using uniform evaluation criteria based on their answers—outliers were capped. These scores were then normalised between 0 to 1. Finally, the average of these normalised scores made the sub-index scores, and the average of the sub-indices made the Penetration and Maturity index of the respective vendors.

This year 41 data science service providers participated in the study, of which 33 made it to the quadrant. No fee was charged for participation in the survey, and the participation was voluntary. The questions were answered by the companies using a Google Form. We reached back to nominees in case of discrepancies or clarifications required.

The vendors not mentioned in the report either did not participate in the study or did not meet the minimum criteria to be scored and plotted on the PeMa quadrant.

The hierarchy used to calculate these sub-indices (using the answers to the survey questions) and then to calculate the Penetration and Maturity can be seen in the chart below.

The below table presents the sub-index and Penetration and Maturity scores of all the vendors that made it to the PeMa Quadrant 2021. Click on the column headers of the table to sort the table on that index. Use the metric slider on the right-side top corner of the table (that appears when you hover over the table) to filter vendors based on their index scores.

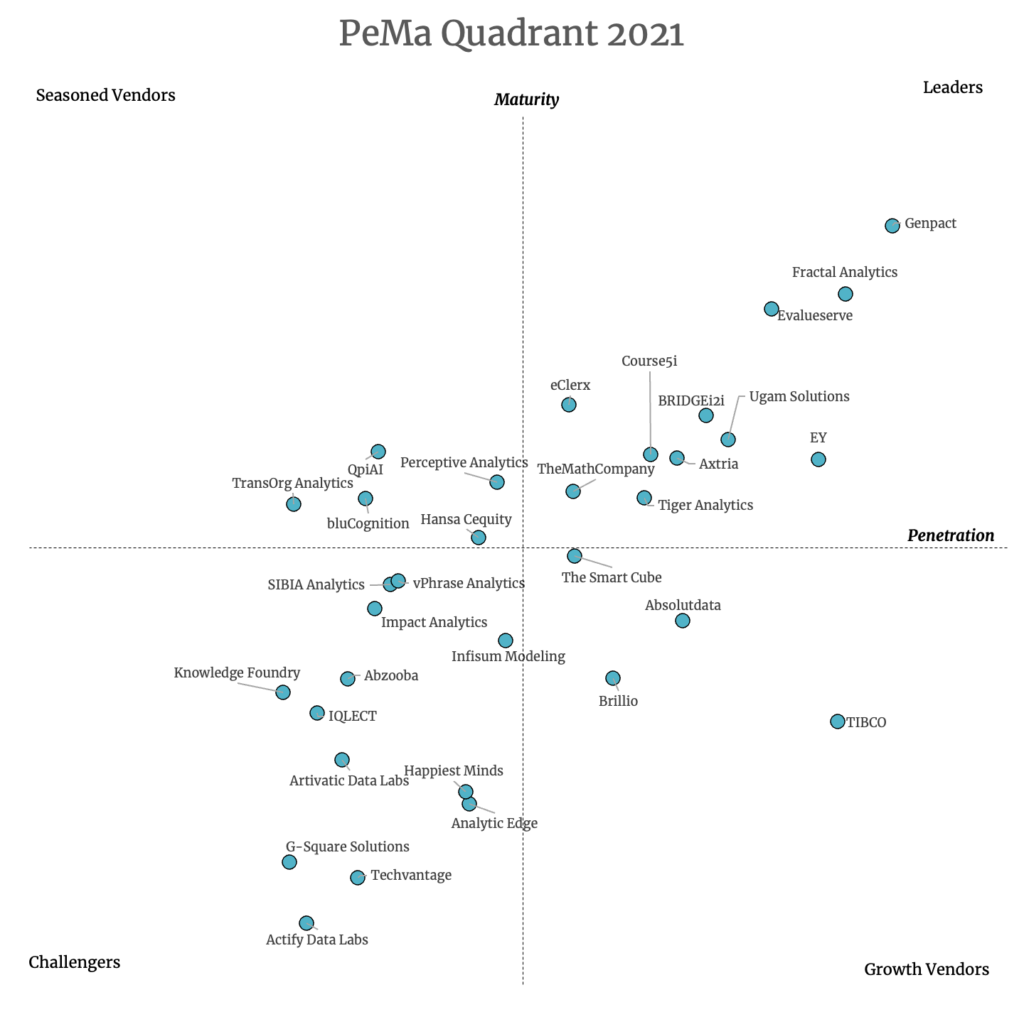

The PeMa Quadrant is plotted based on the Penetration and Maturity scores of the companies — hence the companies are placed in one of the four quadrants — Leaders, Seasoned Vendors, Challengers and Growth Vendors, respectively.

Below we will look at the scores of some of the vendors in each quadrant. For a detailed account of all the vendors and understand how they fare across different sub-indices and their Penetration and Maturity, scroll to the bottom of the article to download the full report.

Leaders

The data science vendors in this quadrant are strong in terms of their penetration as well as maturity. These are vendors with a strong market presence across industries or geographies and exhibit consistent growth. In addition, they have well-established teams that can deliver end-to-end services using state-of-the-art technologies.

Genpact

A leader even in the Leader Quadrant, Genpact is ahead of all of the data science providers in terms of Penetration (0.80) and Maturity (0.72).

Genpact ranks highest in both the Company Outreach and the Customer Confidence sub-index with a score of 0.92 and 0.91, respectively. However, the firm does not fare (0.56) well in terms of growth compared to the other Leaders and Growth Vendors.

The data science team at Genpact has worked on some of the most exciting projects. Although, it needs to be considered that only 40% of the data scientists at Genpact work on advanced analytics. Genpact stands 10th in the Work Delivery sub-index with a score of 0.70. It performs well on Support Function (0.76) and Employee Maturity (0.70), standing second within both the sub-indices.

Fractal

Maintaining its high Penetration (0.75) and Maturity (0.67) scores, same as last year, Fractal Analytics comes at second place in both.

The company is known for its strong CPG customer base, with almost all of the biggest CPG brands a part of its portfolio. It ranks second in the Company Outreach and Customer Confidence with a score of 0.85 and 0.84 in the respective sub-indices.

Fractal ranks fourth in its Work Delivery sub-index with a score of 0.80—70% of its data scientists work in Advanced Analytics. The firm scores 0.63 and 0.59 on Employee Maturity and Support Function sub-indices, respectively.

Evalueserve

Evalueserve scores 0.67 in Penetration and 0.66 in Maturity, putting it in the top 5 of both the indices and the Leaders Quadrant.

Evalueserve has one of the highest numbers of clients, with a significant number of them from the Fortune 500 list. It ranks fifth in the Customer Confidence ranking with a score of 0.76. The firm also has a high score (0.84) in Company Outreach, ranking third within the sub-index. However, it scores low (0.40) on Growth to rank 10th.

The data scientists at Evalueserve get access to a vast number of tools and a significantly high marketing budget. As a result, Evalueserve ranks the highest on the Support Function sub-index with a score of 0.78. The firm has around 60% of data scientists engaged in advanced analytics to score 0.53 on its Work Delivery sub-index.

Other companies that make it into the Leaders Quadrant are EY, eClerx, Axtria, Ugam, Course 5i, Tiger Analytics, The Math Company, and Bridgei2i.

Seasoned Vendors

These are vendors with strong technical capabilities and consulting experience. While seasoned vendors have a stronghold on maturity, they need to grow their market strength and capture the upcoming growth areas in terms of penetration.

Perceptive Analytics

Perceptive Analytics earns a promotion to the Seasoned Vendors Quadrant with a Maturity score of 0.54. It also has the highest penetration score (0.37) among all the Seasoned Vendors.

Perceptive Analytics performs well on Maturity because of its Employee Maturity (0.58) and Support Function (0.54) sub-index scores. The firm has one of the lowest attrition rates and performs better than many on its median employee tenure. It also has a considerable budget allocated for R&D and Marketing to support its analytics unit.

The firm had the third-highest growth in terms of its data science team size to earn a score of 0.64 in the Growth sub-index. However, the firm scored low on both Customer Confidence (0.32) and Company Outreach (0.15), keeping it from entering the Leaders Quadrant.

QpiAI

Ranking seventh in Maturity with a score of 0.57, QpiAI makes its debut in the Seasoned Vendors Quadrant.

The firm’s signature product QpiAI Pro is an end-to-end AutoML platform that enables users to train, deploy and monitor models. The product company has almost all employees (95%) working on Advanced Analytics, giving it a Work Delivery score of 0.65 to rank 12th within the sub-index.

The company invests heavily in R&D to further its research in Quantum computing as it aims to leverage the technology to maximise data-to-insight efficiency. Together, the research budget and the resources the company has made available for its data scientists put the company in the third spot of the Support Function sub-index with a score of 0.70.

Hansa Cequity, bluCognition, and TransOrg Analytics are other vendors to make it into the Seasoned Vendors Quadrant.

Growth Vendors

These vendors with significant market penetration have shown rapid growth in their revenues in the recent past. In terms of maturity, the Growth vendors provide comprehensive analytics solutions and technological frameworks. In addition, their data science teams effectively build solutions that add value to their consulting offerings.

TIBCO

With a score of 0.74, TIBCO has the third-highest Penetration index of all the vendors. However, it does not fare as well in terms of Maturity, with a score of just 0.38.

TIBCO is the preferred choice of data science vendor to some of the biggest brands in the world across different sectors. Almost all of its clients are from the Fortune 500 list of companies. It also has the highest number of offices among the data science vendors spread across the globe. The firm ranks third and fourth in Customer Confidence and Company Outreach with a score of 0.82 and 0.80 in respective sub-indices.

On the other hand, TIBCO had relatively lower growth in terms of its clients and its data science unit in FY 2021. It also does not anticipate growth as high as other vendors in the coming years and ranks eighth in the Growth sub-index with a score of 0.59.

Absolutdata

Absolutdata ranks eighth in Penetration with a score of 0.57 and 21st in Maturity with 0.45, as it maintains its spot in the Growth Vendors Quadrant as last year.

The firm has the fifth-highest number of clients of all the vendors, around a third of which are from the Fortune 500 list of companies. It does very well on its Customer Confidence score (0.68), standing 7th in the sub-index. With seven offices spread across India, Middle East, Europe, and the US, Absolutdata provides its services to almost all geographies. The company ranks 11th in the Company Outreach sub-index with a score of 0.57.

Absolutdata has one of the best scores in Work Delivery (0.72), ranking eighth in the sub-index. However, it needs to improve its Employee Maturity and Support Function scores to make it to the Leader’s Quadrant.

Brillio and The Smart Cube are the other two companies that make it to the Growth Vendors Quadrant.

Challengers

Challengers are niche analytics providers that serve limited geographies. However, with a relatively smaller size and breadth of offerings, they usually have a strong training and delivery approach.

Thirteen data science vendors make it to the Challengers Quadrant, including vPhrase, SIBIA Analytics, Impact Analytics, Infisum Modeling, Abzooba, Knowledge Foundry, IQLECT, Artivatic Data Labs, Happiest Minds, Analytic Edge, G-square Solutions, Techvantage, and Actify Data Labs.

You can read the entire report here.

Nominations are open for Top Data Science Providers for 2022. Submit your nominations here.